Twins and investing

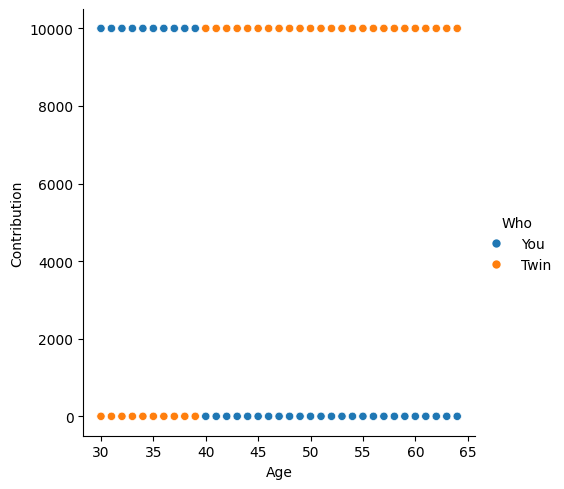

Imagine you and a twin each start investing $10,000 annually, but at different times. You contribute for 10 years and then stop, while your twin starts after you stop and contributes until retirement age. Who ends up with more money at age 65? How does the annual interest rate affect the outcome?

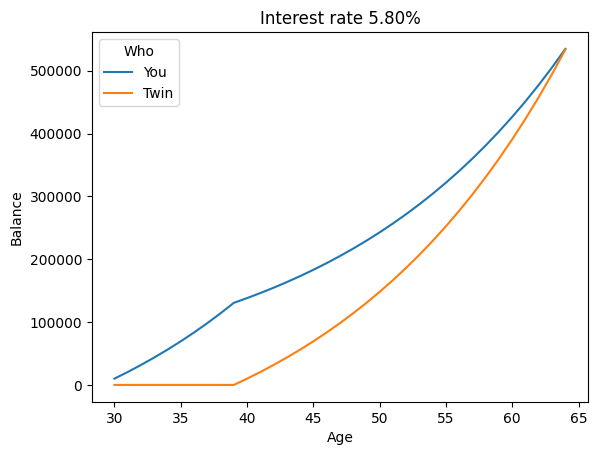

There’s a tipping point interest rate where the results tie. Above that rate, compounding interest works in your favor, making your earlier contributions grow faster. Below that rate, your twin wins because of their higher total contributions.

For example, if you start contributing at age 30:

You contribute $10,000 annually for 10 years, totaling $100,000. Your twin starts after you and contributes $10,000 annually for 25 years, totaling $250,000.

At a 5.8% annual interest rate, the results are nearly identical, both ending up with slightly over $500,000 by age 65. Despite your lower contributions, the power of compounding interest levels the playing field.

Who would you rather be in this scenario? You or your twin?

In a follow-up, we’ll explore whether maintaining a 5.8% annual interest rate over 35 years is realistic.

P.S. A parameterized Jupyter notebook was used to create these charts, so you can try adjusting the numbers yourself.