6% per year for 35 years

In the post Twins and Investing, we discussed how, with a hypothetical annual interest rate of close to 6%, starting contributions early with a smaller total amount can tie at retirement age with someone who starts later but contributes significantly more. This scenario assumes a 35-year investing career. But does such an investment exist?

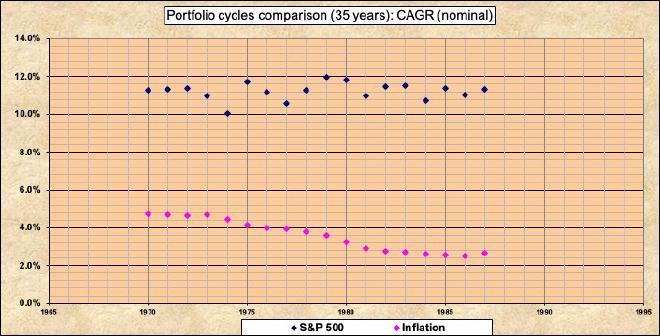

From 1970 to 2021, the S&P 5001 had a compound annual growth rate (CAGR) of 11.07% 2 over 52 years—far above the hypothetical 6%. While the stock market is volatile, analyzing 35-year rolling windows (portfolio cycles) of CAGR provides more clarity.

Here, a portfolio cycle is a rolling 35-year period, such as 1970–2004, 1971–2005, and so on. As shown in the chart2 above, the S&P 500’s CAGR across all these 35-year periods fluctuates but consistently remains around 11%, well above 6%. This means that for any 35-year period starting since 1970, you would surpass the hypothetical 6% break-even rate.

In the Twins and Investing scenario, this higher CAGR means compounding works in your favor. If you start contributing early, you’ll outperform or tie with your twin, even with lower total contributions.

Does such an investment exist?

Yes, there are multiple index mutual funds3 or ETFs that track the S&P 500. For example, I use one of these funds personally.

Backtesting spreadsheet rev21b at Bogleheads forum. https://www.bogleheads.org/wiki/Simba%27s_backtesting_spreadsheet ↩︎ ↩︎

Index fund: https://en.wikipedia.org/wiki/Index_fund ↩︎