Retirement portfolios

Table of Contents

In this post, we showed that the S&P 5001 stock market index is a candidate investment that results in a bigger nest egg than our twin’s. In this post, we discuss mutual fund products, including an S&P 500 one, that we can invest in. A portfolio can own one or more mutual funds. We will make a comparison between a few portfolios that are candidates for retirement investing.

S&P 500 index fund #

In the Berkshire Hathaway 2016 shareholders letter2, Warren Buffett recommends:

Both large and small investors should stick with low-cost index funds. (…) My regular recommendation has been a low-cost S&P 500 index fund.

Two-fund portfolio #

According to modern portfolio theory3, one should own a portfolio of diversified assets. The idea is that owning different types of asset is less risky than owning only one type. In other words, it is possible to design a portfolio with same risk but higher returns or with same returns but lower risk, as compared to a portfolio with just one type of asset 4.

A simple diversified portfolio is a two-fund portfolio, consisting of stocks and bonds. How should one allocate how much for stocks and how much for bonds? A well-known rule of thumb is to subtract one’s age from 1105. The resulting number is the percentage of stocks in the portfolio.

$$ stock\_percent = 110 - age \\ bond\_percent = 100 - stock\_percent $$

For example, if one is 30 years old, then 110 - 30 = 80. So the two-fund portfolio would be 80% stocks and 20% bonds. Vanguard offers many low-cost index funds. One possible portfolio is:

| Fund | Allocation (%) |

|---|---|

| Vanguard Total Stock Market Index Fund | 80 |

| Vanguard Total Bond Market Index Fund | 20 |

Target year funds #

One family of Vanguard funds is the Target Retirement funds6. They each have a year in their name. For example, Vanguard Target Retirement 2055 Fund7. The year means the “retirement” year of one’s portfolio, i.e., the year from which one will start withdrawing. All the funds in this family consist of the same five underlying Vanguard index funds. Each target year fund differs by the different percent allocation of the five underlying index funds. These five are:

- Vanguard Total Stock Market Index Fund

- Vanguard Total International Stock Index Fund

- Vanguard Total Bond Market II Index Fund

- Vanguard Total International Bond II Index Fund

- Vanguard Short-Term Inflation-Protected Securities Index Fund

My retirement portfolio #

Vanguard isn’t the only company that has a family of target year funds. Fidelity also does. In early 2000s, I created the asset allocation of my retirement portfolio. Perhaps I didn’t know that target year fund existed, or maybe they didn’t. I took Index Fund Advisor’s IFA 100 allocations8 and replaced the underlying funds with similar-asset Vanguard index funds.

| Fund | Allocation (%) |

|---|---|

| IFA US Large Company Index | 12 |

| IFA US Large Cap Value Index | 12 |

| IFA US Micro Cap Index | 20 |

| IFA US Small Cap Value Index | 20 |

| IFA Real Estate Index | 5 |

| IFA International Value Index | 6 |

| IFA International Small Company Index | 6 |

| IFA International Small Cap Value Index | 6 |

| IFA Emerging Markets Index | 4 |

| IFA Emerging Markets Value Index | 4 |

| IFA Emerging Markets Small Cap Index | 5 |

Vanguard did not have some equivalents. I chose substitutes that are as close as possible. This is what I came up with, which I call “Rick 100”.

| Fund | Allocation (%) |

|---|---|

| Vanguard Value Index Fund | 12 |

| Vanguard 500 Index Fund | 12 |

| Vanguard Small Cap Value Index Fund | 20 |

| Vanguard Small-Cap Index Fund | 20 |

| Vanguard Real Estate Index Fund | 5 |

| Vanguard Developed Markets Index Fund | 9 |

| Vanguard International Value Fund | 9 |

| Vanguard Emerging Markets Stock Index Fund | 13 |

Comparison #

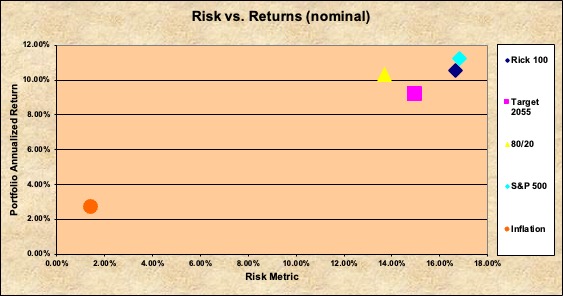

Supposed an imaginary investor is 30-years old. They will retire 35 years later. Thus far we have four portfolios: the S&P 500, an 80/20, a target year fund and Rick 100. For the S&P 500, we choose the Vanguard 500 Index Fund9. Vanguard Target Retirement 2055 Fund would be the target year portfolio (2055 - 2022 = 32). Using this backtesting spreadsheet10, here is the risk (standard deviation) vs returns from 1987 to 2021 (35 years) of these 4 portfolios.

For returns, the higher, the better. For risk, the lower, the better. The S&P 500 portfolio has the highest returns. The 80/20 portfolio has the lowest risk. In general, the higher the returns the higher the risk.

Now the following questions arise:

- Which portfolio is right for me?

- How to implement these portfolios in the US and in Japan?

- These portfolios are heavy in stocks. It makes sense at the beginning of the investing career. Doesn’t it seem more and more risky when I am closer and closer to retirement age?

I hope to answer them in future posts.

Footnotes #

the S&P 500: https://en.wikipedia.org/wiki/S%26P_500 ↩︎

Berkershire Hatheway 2016 Shareholders Letter, pg 24. https://www.berkshirehathaway.com/letters/letters.html ↩︎

Modern Portfolio Theory: https://en.wikipedia.org/wiki/Modern_portfolio_theory ↩︎

Portfolio management. Stanford University. https://youtu.be/8TJQhQ2GZ0Y?t=2585 ↩︎

An assumption is that retirement age is 65. ↩︎

Vanguard Target Retirement Funds: https://investor.vanguard.com/investment-products/mutual-funds/target-retirement-funds ↩︎

Vanguard Target Retirement 2055 Fund: https://investor.vanguard.com/mutual-funds/profile/VFFVX ↩︎

IFA no longer publishes allocation percentages today. However, the Internet Archive has past snapshots: https://web.archive.org/web/20050612021001/http://www.ifa.com/portfolios/p100/ ↩︎

Vanguard 500 Index Fund: https://investor.vanguard.com/mutual-funds/profile/VFIAX ↩︎

Backtesting spreadsheet rev21b at Bogleheads forum. https://www.bogleheads.org/wiki/Simba%27s_backtesting_spreadsheet ↩︎