Posts

2024

Download Spotify music

“spotDL finds songs from Spotify playlists on YouTube and downloads them - along with album art, lyrics and metadata.” 1

Process images in batch

Imagemagick comes with a command-line tool called morgrify. It can process images in batch. Here are some examples of converting formats and resizing images.

A way to get over breaking up

Given the events, feeling sad is normal. It is a human experience. It is also an opportunity.

2023

ETF-variant 2023 Asset Allocation

The Vanguard mutual funds in my Vanguard 100 asset allocation may not be available for non-US investors. Here is an equivalent asset allocation consisted of exchange-traded funds (ETF’s).

2023 Asset Allocation

In mid 2000’s, I replaced the constituent funds in side the IFA 100 asset allocation with Vanguard index funds. At that time, Vanguard did not have an international small-cap index fund. Instead, I chose the Vanguard Developed Market Index Fund, which is an international large-cap style.

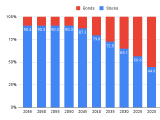

The glide path of asset allocation

An asset allocation is the percentage for each asset in a portfolio. Suppose a portfolio is investing for retirement, then as an investor’s age nears the retirement age, the percentages should be adjusted. This change over time is called the glide path of an asset allocation.