Investing

2025

The Magnificent Seven and S&P 500

The Magnificent Seven1 is a group of technology companies. This group is a significant weighting in the S&P 500.

2023

ETF-variant 2023 Asset Allocation

The Vanguard mutual funds in my Vanguard 100 asset allocation may not be available for non-US investors. Here is an equivalent asset allocation consisted of exchange-traded funds (ETF’s).

2023 Asset Allocation

In mid 2000’s, I replaced the constituent funds in side the IFA 100 asset allocation with Vanguard index funds. At that time, Vanguard did not have an international small-cap index fund. Instead, I chose the Vanguard Developed Market Index Fund, which is an international large-cap style.

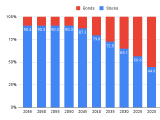

The glide path of asset allocation

An asset allocation is the percentage for each asset in a portfolio. Suppose a portfolio is investing for retirement, then as an investor’s age nears the retirement age, the percentages should be adjusted. This change over time is called the glide path of an asset allocation.

2022

Changing GnuCash font size

GnuCash is a software that can track portfolio transactions and performance. There is a binary release for Apple macOS. On a retina display, the application has a very small font and is very hard to read. Fortunately, it is easy to change the font size via a CSS file 1.

Emergency fund with better returns yet safe

It is a common rule-of-thumb to keep 6 months of expenses in cash as emergency fund. Sometimes the recommedation is 3 or even 12 months. Is there a better way than parking that cash in the bank?

Contribution priority for retirement accounts

It’s a common sense to pay off the debt with the highest interest first. This also applies to retirement investment accounts.